Debt Cancellation for Global South & Uganda: Why it’s justifiable & the implications for climate change action!

On 11th April 2023, I (or Miklah Life) joined fellow members of ‘Debt for Climate Uganda’ (or Debt for Climate International) to demand for debt cancellation of debts owed by Global South countries, especially those in Africa, Uganda inclusive. In the press conference we held at Mawanda Gardens, Kireka, we demanded the World Bank and International Monetary Fund (IMF) to have debt cancellation as a priority topic on their agenda in the ongoing spring meetings in Washington DC, USA.

Of course, some believe and support this advocacy while others don’t see any justification for such a demand! In this article, we will discuss why it is justifiable for IMF and World Bank and rich countries to cancel out debts owed by developing countries like Uganda and how this debt cancellation is relevant to climate action in developing countries of Africa, especially Uganda.

Debt Cancellation: Debt crisis in developing countries

The International Monetary Fund (IMF) and the World Bank have been lending money to developing countries like Uganda for many years. However, the debt burden has become unsustainable, and many countries are struggling to pay back their loans. This debt crisis has significant implications for climate action in developing countries of Africa, particularly Uganda. This hinders socioeconomic transformation and, most importantly, thwarts all efforts intended for climate action.

Developing countries like Uganda have been struggling with an ever-increasing debt burden for many years. According to the World Bank, the total external debt of developing countries reached $8.1 trillion in 2020, up from $7.8 trillion in 2019.

This debt crisis is particularly acute in Africa, where many countries are spending more on debt servicing and repayment than on critical social services such as health and education. Globally, total debt is more than twice the global GDP, lol. Crazy capitalism! In other words, combined, all world’s goods and services can’t pay off the debt! Who runs life like that, always more than what was given being demanded?

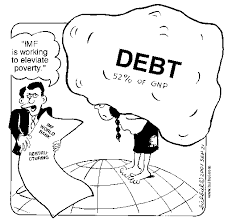

In Uganda, Uganda’s debt-to-GDP ratio, for instance, has risen from 20% in 2012 to 47% in 2020. In fact, as of today, Uganda’s total debt is more than 50% of the GDP, implying that more than ½ of Uganda’s goods and services is actually not Uganda’s but for big creditors like China, IMF, and the World Bank. As Charles Eisenstein remarks in his book, Sacred Economics, ‘we are slaves or laborers of money owners’, a situation he calls ‘debt peonage’

This debt crisis is largely the result of unsustainable lending practices by the IMF and World Bank and rich countries. For example, many loans are given without regard for a country’s ability to pay them back, and the interest rates on these loans are often exorbitant. As a result, many countries find themselves trapped in a cycle of debt, borrowing more to pay off existing loans.

Debt Cancellation: The implications of the debt crisis for climate action

Firstly, countries that are struggling with debt are less likely to have the financial resources needed to invest in renewable energy and other climate-friendly initiatives. Instead, they are forced to prioritize debt repayment over climate action. According to the International Institute for Sustainable Development, debt service payments consumed an average of 26% of African countries’ government revenues in 2019, leaving little room for investment in climate action.

For example, in Uganda, debt servicing takes up a significant portion of the national budget, leaving little room for investments in social programs or climate-friendly initiatives. According to a report by the Jubilee Debt Campaign, Uganda spent 11.2% of its budget on debt servicing in 2019, while only 3.7% was allocated to education and 2.7% to health. This indicates that debt servicing is taking precedence over investments in social programs that would benefit the population and the planet. In other words, for most of these developing countries, more money is for debt servicing and repayment and less money is for anything else!

As a result, many countries are forced to rely on fossil fuels to generate electricity because they lack the financial resources to invest in renewable energy. For example, Uganda’s energy mix is dominated by hydropower, which accounts for 83% of its electricity generation. However, the country is facing a severe electricity shortage, and its government plans to get energy relief, probably cooking gas, from oil explorations. This is despite the fact that Uganda has vast untapped potential for renewable energy, including solar, wind, and geothermal. In Botswana, Kenya, and other African countries, writes The Economist, the goal is to burn more coal!

Indeed, if it wasn’t poverty and, probably, ignorance, who would want to use firewood for cooking when there is gas or electricity? Get reminded that firewood use is between 70 and 90% in Uganda, implying that every homestead is likely using firewood or charcoal. Too bad.

Secondly, the debt crisis in developing countries is contributing to mushrooming of unsustainable projects or ‘crude-capitalistic’ practices that worsen climate change. When one takes on debt, he is no longer free to do as he pleases. When a country is heavily indebted, it may resort to resource extraction and other environmentally harmful practices to generate revenue to service the debt.

For example, many heavily indebted countries in Africa have turned to extractive industries like mining and oil exploration to generate revenue to service their debt. Specifically for Uganda, national eyes are currently on oil extraction from L. Albert (EACOP project) and other mining projects. While these may not be environment friendly programs, Uganda hopes to generate more revenue, service and pay her debts and save for socioeconomic development. However, as always, this will likely lead to more debts, environmental degradation and damage to local communities.

In other words, for a country like Uganda, debt jeopardizes our ability to prioritize climate-friendly businesses, and instead focus on money and profits at the expense of everything else. Let me explain!

DEBT CANCELLATION: IMF, WORLD BANK, AND STRUCTURAL ADJUSTMENT PROGRAMS

IMF and World Bank have forever been implicated for mushrooming crude-capitalistic practices that increase inequalities and broaden the gap between the rich and the poor and, ultimately, don’t care about anything else other than money and profits. According to various scholars, for example, Jamie Martin of Harvard University and author of books like ‘The Meddlers’, IMF and World Bank give their loans based on a criterion called structural adjustment programs (SAPs), which in itself is an anti-social development agenda (see here and here).

According to Investopedia, structural adjustment programs (SAPs) are a ‘set of economic reforms that a country must adhere to in order to secure a loan from the International Monetary Fund and/or the World Bank’. They include policies like increase of taxes, increased privatization, reduced Government spending, and opening to free trade (also called, austerity).

As you can see, to be eligible for IMF and World Bank loans, a country must embrace crude-capitalism and throw away efforts to do with social services like hospitals, public schools, or even justice, including nature or climate justice. It is important to note that it is almost impossible for a government under such a policy to invest in social and environment friendly initiatives, which, in most cases, don’t bring in a lot of money and profits! You think I am lying? Well, read and listen to this abstract from International Socialist Alternative:

‘The IMF and World Bank will only extend loans if countries agree to accept ’structural adjustment programmes’ (SAPs). SAPs are forced down the throats of the people of the former colonial world. To pay off the loans, the IMF and World Bank demand governments raise money by selling off public assets and companies (privatisation) and cutting state expenditure on social services like health care, education, and pensions. SAPs require countries de-regulate and “open up” their economies by cutting subsidies to local industries and slashing trade barriers and tariffs.

Countries must open up their economies to the multinationals (usually based in Western countries), remove restrictions on foreign investments, and allow corporations access to the workers and natural resources of the country at bargain basement prices. The vast majority of the profits made by the multinationals are taken out of the country and brought home (repatriated) to the West.

SAPs encourage export-oriented growth (selling cheap raw materials or commodities on the world market, like cash crops, garments, or computer chips) to generate hard currency. All in all, the IMF and World Bank SAPs turn countries into loan repayment machines, generating easy profits for the world’s biggest companies and banks.

IMF policies also both directly and indirectly impact on workers in, for example, Europe and the US. Because they are partially funded with public money, the IMF and World Bank redistribute wealth from working people in the West (through their taxes) and funnel it to programmes which benefit the multinationals. The effects of IMF/World Bank programmes are to lower wages and working conditions worldwide, which exerts a downward pressure on workers’ living standards in the industrialized countries as well.’

Have you got the point?

The point is this: When under debt or loan, one is inclined to invest in money and profit-making machines only, and it doesn’t matter if these ventures are pro or against people and the planet! That is how debt facilitates climate crisis. If you still need more on this, then dive into 1998 Daniel Vila’s position on this ‘nonsense’:

‘Imagine applying for a loan at a bank and being told that in order to receive the money you must agree to being hit in the face by Mike Tyson, in the stomach with a bat swung by Jose Canseco and kicked in the rear by a soccer player every morning for the rest of your life. Paying the money back is not as difficult as surviving the humiliating conditions of the loan. On a global scale, the International Monetary Fund (IMF) and the World Bank impose similar humiliating conditions on poor countries before lending them money. The difference is that most countries that accept the loans do so because they have no other way of avoiding total financial collapse.’

Debt Cancellation: Why debt cancellation is justifiable

Given the implications of the debt crisis for climate action in developing countries, debt cancellation is not only desirable but also justifiable. Here are some reasons why:

Historical responsibility: Many of the debt burdens that developing countries are facing today are a result of lending practices by rich countries and international financial institutions such as the IMF and World Bank. These institutions often provided loans to dictators and corrupt regimes in developing countries, who used the money to enrich themselves rather than invest in their countries’ development. Debt cancellation is thus a way for rich countries to take responsibility for their role in creating the debt crisis.

Economic recovery: Debt cancellation would provide much-needed relief to developing countries struggling with debt, allowing them to redirect resources towards social services, health, education, and climate action. This would not only benefit the people of these countries but also contribute to global economic recovery.

Moral obligation: Debt cancellation is a moral obligation for rich countries, as it would enable developing countries to achieve the Sustainable Development Goals and contribute to global efforts to address climate change. Rich countries have a responsibility to ensure that all countries have them resources they need to address global challenges such as climate change, and debt cancellation is one way to achieve this.

Long-term benefits: Debt cancellation would provide developing countries with the financial resources needed to invest in renewable energy and other climate-friendly initiatives. This would not only benefit these countries but also contribute to global efforts to address climate change. Renewable energy is key to achieving a sustainable, low-carbon future, and investing in it now would provide long-term benefits for everyone.

Fairness: Debt cancellation is also a matter of fairness. Many developing countries have already paid back their loans several times over, yet they continue to face increasing debt burdens. Debt cancellation would level the playing field and ensure that all countries have an equal chance to invest in their future.

Debt Cancellation: The Role of IMF, World Bank, and Rich Countries

Rich countries have a crucial role to play in debt cancellation. They can provide the financial resources needed to cancel debts owed by developing countries like Uganda, and they can also advocate for debt cancellation at the international level. The G20 group of countries, for example, has already provided some debt relief to developing countries, but more needs to be done.

In addition to debt cancellation, IMF, World Bank, and rich countries must strictly reduce the tendency of countries to take on debts, especially those under poor leadership or with poor records of financial management.

They can also provide developing countries with the technical expertise and support needed to invest in renewable energy and other climate-friendly initiatives. This would help these countries to transition to a low-carbon economy and contribute to global efforts to address climate change.

Debt Cancellation: Conclusion

Debt cancellation is justifiable for developing countries like Uganda, given the implications of the debt crisis for climate action. It would provide much-needed relief to these countries and enable them to invest in renewable energy and other climate-friendly initiatives. Rich countries, IMF and World Bank have a crucial role to play in debt cancellation, and they should take responsibility for their role in creating the debt crisis. Debt cancellation is not only a matter of fairness but also a moral obligation for rich countries, as it would contribute to global efforts to address climate change and ensure that all countries have the resources they need to invest in their future.

It’s upon the above information or facts that I (or Miklah Life) proudly partners with Debt for Climate Uganda to demand for a debt free future! How is that?

There could be another or even better alternative! Have you ever heard of debt swapping or swapping debts for climate funding? Lol. We will explore this soon! Thank you.